Medical expenses can often be a significant financial burden, and managing them effectively is crucial to maintaining a healthy credit score. Unpaid medical bills can negatively impact your creditworthiness and make it challenging to obtain credit in the future. In this article, cmd99 will discuss essential tips on how to protect credit score during medical bills. By following these strategies, you can navigate the financial challenges of medical expenses while safeguarding your creditworthiness.

How to Protect Credit Score During Medical Bills: Essential Tips

- Understand Your Medical Bills:

The first step in How to protect credit score during medical bills is to gain a thorough understanding of the bills you receive. Carefully review each bill for accuracy, ensuring that the services listed are the ones you received and that the charges are correct. If you notice any discrepancies or errors, contact the healthcare provider or billing department promptly to address the issue. Resolving billing errors promptly can prevent unnecessary delays and disputes that may impact your credit score. - Communicate with Healthcare Providers:

If you are facing difficulties How to protect credit score during medical bills, it is essential to communicate with your healthcare providers. Many hospitals and medical facilities offer financial assistance programs or flexible payment options for patients facing financial hardships. Reach out to the billing department or financial counselor to discuss your situation and explore the available options. By proactively communicating, you can find a solution that works for both parties and prevent negative consequences on your credit score. - Negotiate and Set Up Payment Plans:

If you are unable to pay How to protect credit score during medical bills in full, consider negotiating with the healthcare provider to set up a payment plan. Many providers are willing to work with patients and establish affordable monthly payment arrangements. By setting up a structured payment plan, you can demonstrate your commitment to fulfilling your financial obligations and avoid having the bills sent to collections, which could harm your credit score.

- Review Your Insurance Coverage:

Understanding your health insurance coverage How to protect credit score during medical bills is crucial when it comes to managing medical bills. Review your insurance policy to determine the extent of coverage for the medical services you received. Be aware of deductibles, co-pays, and any out-of-pocket expenses that you are responsible for. If you believe a claim was incorrectly processed or denied, reach out to your insurance provider for clarification and to file an appeal if necessary. By ensuring that your insurance coverage is accurately applied, you can minimize your out-of-pocket expenses and protect your credit score. - Seek Financial Assistance and Resources:

In addition to working directly with your How to protect credit score during medical bills providers, explore other financial assistance options available to you. Non-profit organizations, local charities, and government programs may provide assistance to individuals struggling with medical bills. Research and inquire about available resources that can help alleviate the financial burden. Utilizing these resources can prevent your medical bills from negatively impacting your credit score. - Consider Medical Debt Consolidation:

If you have accumulated multiple How to protect credit score during medical bills from different providers, medical debt consolidation may be a viable option. Consolidating your medical debt involves combining multiple bills into a single loan or payment plan. This can simplify the repayment process and potentially reduce interest rates and fees. By consolidating your medical debt, you can manage your payments more effectively and minimize the risk of missed or late payments that can harm your credit score. - Prioritize Your Payments:

When faced with limited financial resources, it is crucial to prioritize your payments strategically. While it is essential to fulfill your medical obligations, it is also crucial to prioritize other financial obligations, such as mortgage or rent payments, utilities, and other debts. By prioritizing your payments, you can ensure that you meet your essential financial obligations while still addressing your medical bills. This approach can help protect your credit score by minimizing the risk of missed or late payments. - Monitor Your Credit Report:

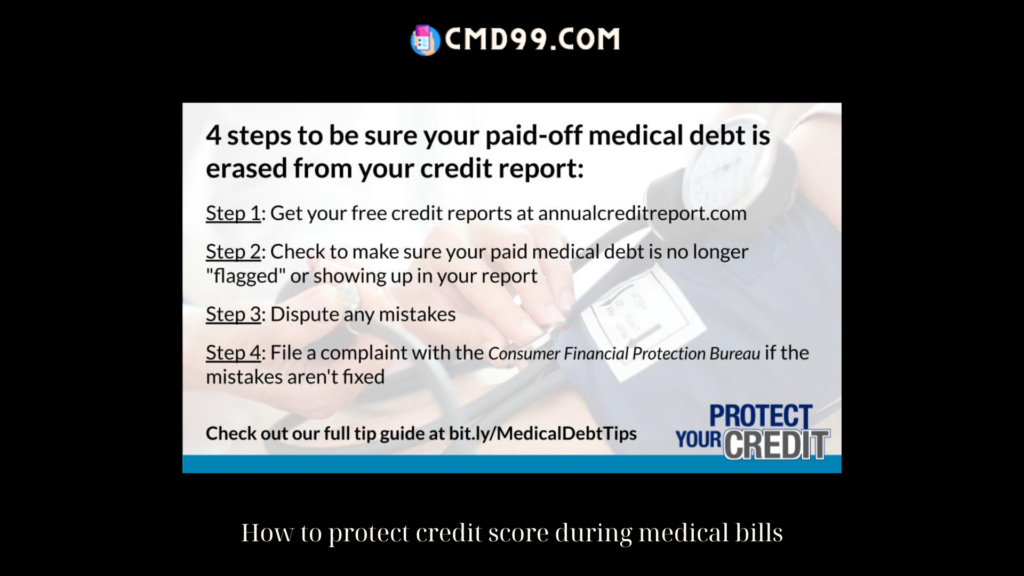

Regularly monitoring your credit report is How to protect credit score during medical bills essential to protect your credit score. Keep a close eye on your credit report to ensure that your medical bills are accurately reported. If you notice any errors or discrepancies, such as unpaid bills that have been resolved or bills that do not belong to you, take immediate action to dispute and correct the inaccuracies. By staying vigilant and addressing any credit reporting errors promptly, you can maintain the integrity of your credit score. - Seek Professional Help if Needed:

If you find How to protect credit score during medical bills yourself overwhelmed by medical bills and struggling to protect your credit score, it may be beneficial to seek professional assistance. Credit counseling agencies and financial advisors can provide guidance on managing your debts, negotiating with creditors, and creating a realistic budget. Their expertise can help you develop a comprehensive plan to protect your credit score and regain control of your financial situation.

- Conclusion:

Protecting your credit score during medical bills requires proactive and strategic financial management. By understanding your bills, communicating with healthcare providers, negotiating payment plans, reviewing insurance coverage, seeking financial assistance, and prioritizing your payments, you can navigate the challenges of How to protect credit score during medical bills medical expenses while safeguarding your creditworthiness. Regularly monitoring your credit report and seeking professional help when needed further contribute to protecting your credit score. By implementing these essential tips, you can minimize the impact of medical bills on your credit score andmaintain a strong financial foundation for the future. Remember, proactive measures and open communication are key to protecting your credit score during medical bill challenges.