Experiencing a foreclosure can have a significant impact on How to improve credit score after a foreclosure. A foreclosure occurs when a homeowner is unable to make mortgage payments, resulting in the lender repossessing the property. This financial setback can make it challenging to obtain credit in the future, as lenders consider individuals with a foreclosure on their credit history to be high-risk borrowers. However, it’s important to remember that your credit score is not permanently damaged. With time, dedication, and the right strategies, you can improve your credit score after a foreclosure. In this article, Cmd99 will explore essential tips and strategies to help you on How to improve credit score after a foreclosure.

How to Improve Credit Score After a Foreclosure: Essential Tips and Strategies

- Understand the Impact of Foreclosure on Your Credit Score:

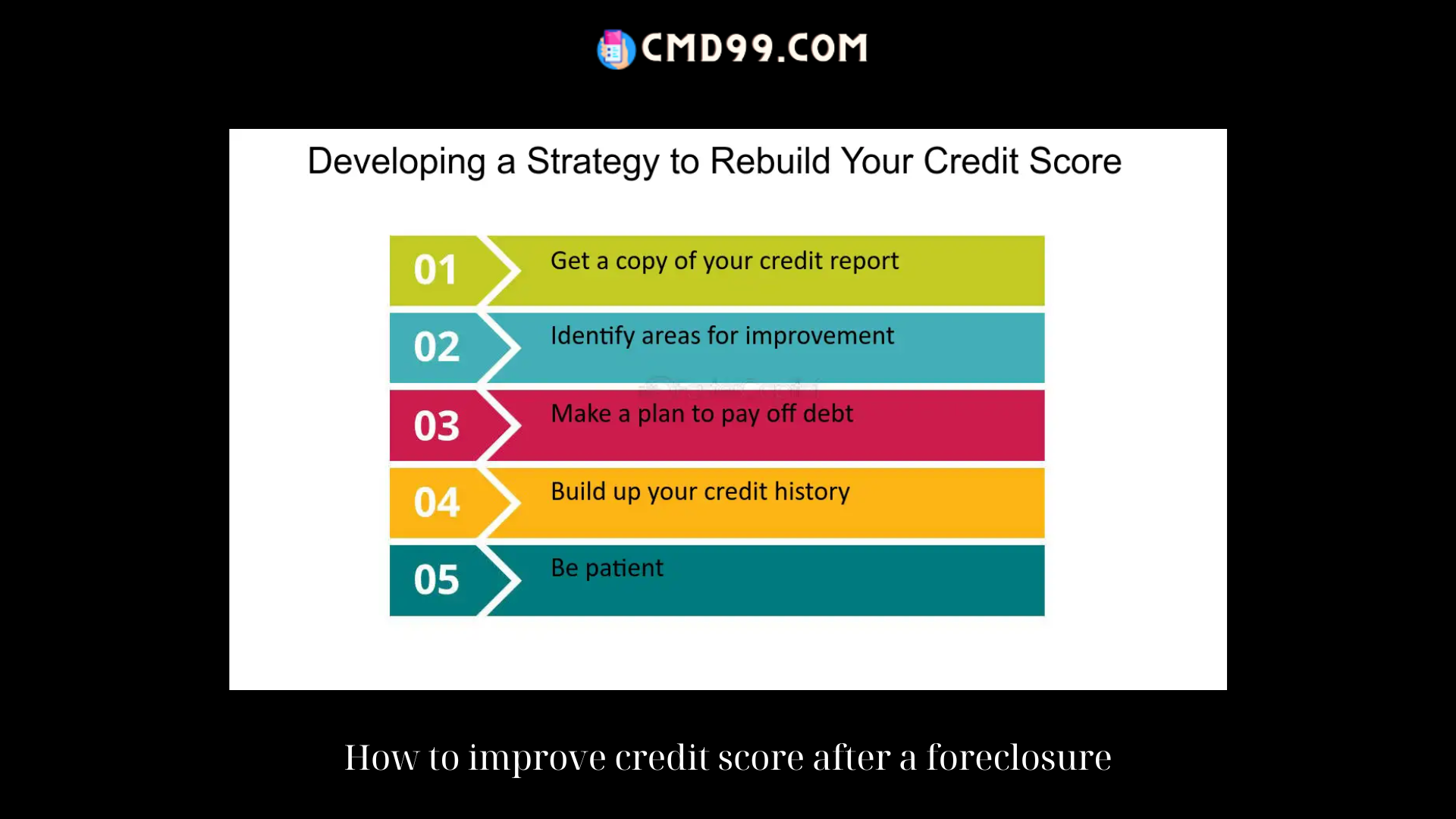

How to improve credit score after a foreclosure? Before you can set out on the path to improving your credit score, it’s crucial to understand how a foreclosure affects it. A foreclosure can cause a substantial drop in your credit score, potentially reducing it by 100 points or more. The negative impact can stay on your credit report for up to seven years. Lenders view a foreclosure as a significant financial misstep, signaling a higher risk of default on future loans. - Review Your Credit Report:

To begin the process of improving your credit score, obtain a copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Carefully review the report to ensure the accuracy of the information. Look for any errors, such as incorrect dates or amounts associated with the foreclosure. Dispute any inaccuracies with the credit bureaus to have them corrected and potentially improve your credit score. - Rebuild Your Credit History:

One key strategy for How to improve credit score after a foreclosure is to focus on rebuilding your credit history. This involves establishing new lines of credit and demonstrating responsible financial behavior. Start by obtaining a secured credit card, which requires a cash deposit as collateral. Use the card sparingly and make timely payments to show creditors that you can handle credit responsibly. - Make Timely Payments:

Consistently making timely payments is crucial on How to improve credit score after a foreclosure improving your credit score. Pay all your bills, including credit cards, loans, and utilities, on time each month. Late payments can further damage your credit score and hinder your progress. Set up automatic payments or use reminders to ensure you never miss a due date. - Keep Credit Utilization Low:

Credit utilization refers to the percentage of How to improve credit score after a foreclosure that you are currently using. To improve your credit score, it’s important to keep your credit utilization low. Aim to use no more than 30% of your available credit. For example, if you have a credit limit of $10,000, try to keep your outstanding balance below $3,000. High credit utilization can be seen as a sign of financial instability and can negatively impact your credit score. - Diversify Your Credit Mix:

Having a diverse credit mix can positively impact on How to improve credit score after a foreclosure. Lenders like to see that you can manage different types of credit responsibly. Consider adding different types of credit to your financial portfolio, such as a car loan or a personal loan. However, be cautious not to apply for too much credit at once, as multiple credit inquiries can negatively affect your credit score.

- Practice Patience:

Rebuilding your How to improve credit score after a foreclosure after a foreclosure takes time and patience. It’s important to recognize that improving your credit score is a gradual process. Consistently practicing good financial habits and demonstrating responsible credit behavior will gradually improve your creditworthiness over time. Avoid quick-fix schemes or credit repair companies that promise instant results but may not deliver on their claims. - Seek Professional Assistance if Needed:

If you find the process of rebuilding your How to improve credit score after a foreclosure overwhelming or confusing, consider seeking professional assistance. Credit counseling agencies can provide guidance and help you develop a personalized plan to improve your credit. They can also negotiate with creditors on your behalf, helping you establish payment plans or settle outstanding debts.

- Maintain a Stable Financial Foundation:

Improving your credit score goes beyond just managing your credit. It’s essential to maintain a stable financial foundation. Create a realistic budget and stick to it, ensuring that you have enough funds to cover your expenses and make timely payments. Build an emergency fund to handle unexpected expenses and avoid falling into further financial distress. - Stay Committed to Healthy Financial Habits:

Lastly, to improve your How to improve credit score after a foreclosure and maintain a healthy financial future, it’s crucial to stay committed to healthy financial habits. This includes consistently monitoring your credit report, avoiding unnecessary debt, and practicing responsible borrowing and spending. By continuing to make positive financial decisions, you can ensure long-term credit improvement and financial well-being.

Conclusion:

While a foreclosure can have a significant impact on your credit score, it’s not the end of your financial journey. By understanding How to improve credit score after a foreclosure and the impact of foreclosure, reviewing your credit report, and implementing essential strategies, you can improve your credit score over time.

Rebuilding your credit requires discipline, patience, and a commitment to responsible financial habits. By staying dedicated to your credit recovery journey and seeking professional assistance when needed, you can regain financial stability and open doors to future credit opportunities. Remember, improving your credit score is a gradual process, but with persistence and the right strategies, you can achieve your goal of rebuilding your creditworthiness and securing a brighter financial future.