Managing debt can be a challenging task, and when faced with overwhelming financial obligations, debt settlement may seem like an appealing option. Debt settlement involves negotiating with creditors to pay off a portion of your outstanding debt, usually in a lump sum payment. While debt settlement can provide some relief from mounting debt, it is essential to consider its potential impact on your credit score and overall financial reputation. In this article, cmd99 will delve into the relationship between Does debt settlement affect credit score?, helping you gain a better understanding of the implications involved.

Does Debt Settlement Affect Credit Score? Understanding the Impact on Your Financial Reputation

To comprehend the impact of debt settlement on your credit score, it is crucial to first grasp the factors that contribute to credit scoring. Credit scoring models, such as the FICO score, take into account several elements to determine an individual’s creditworthiness. These factors include payment history, amounts owed, length of credit history, new credit, and credit mix. Each of these components plays a significant role in shaping your credit score.

Debt settlement Does debt settlement affect credit score? have a significant impact on your credit score and financial reputation. It is crucial to understand the potential consequences before embarking on the debt settlement journey. While the negative effects on your credit score may be unavoidable, exploring alternative debt management options or seeking professional advice can help you make an informed decision. Remember, rebuilding your credit takes time and discipline, but with responsible financial habits, you can gradually improve your creditworthiness and regain your financial stability.

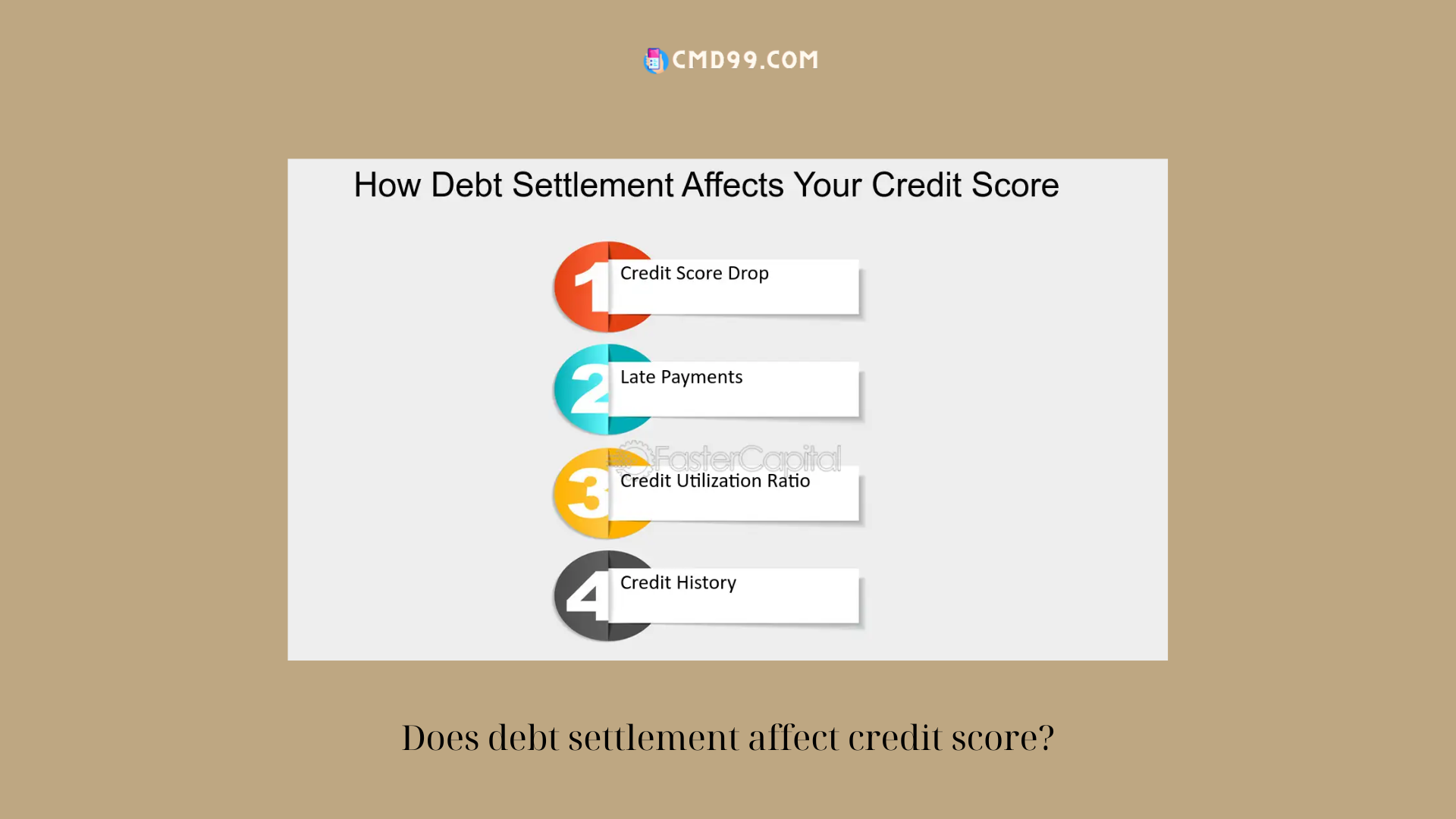

When considering debt settlement, it is important to understand that it can have a negative impact on your credit score. Does debt settlement affect credit score? This is primarily because debt settlement involves not paying off the full amount owed to creditors. Instead, a negotiated settlement is reached, which typically results in a reduced payment. From a creditor’s perspective, this signifies that the borrower was unable to fulfill their financial obligations in full, which can be viewed as a negative indicator of creditworthiness.

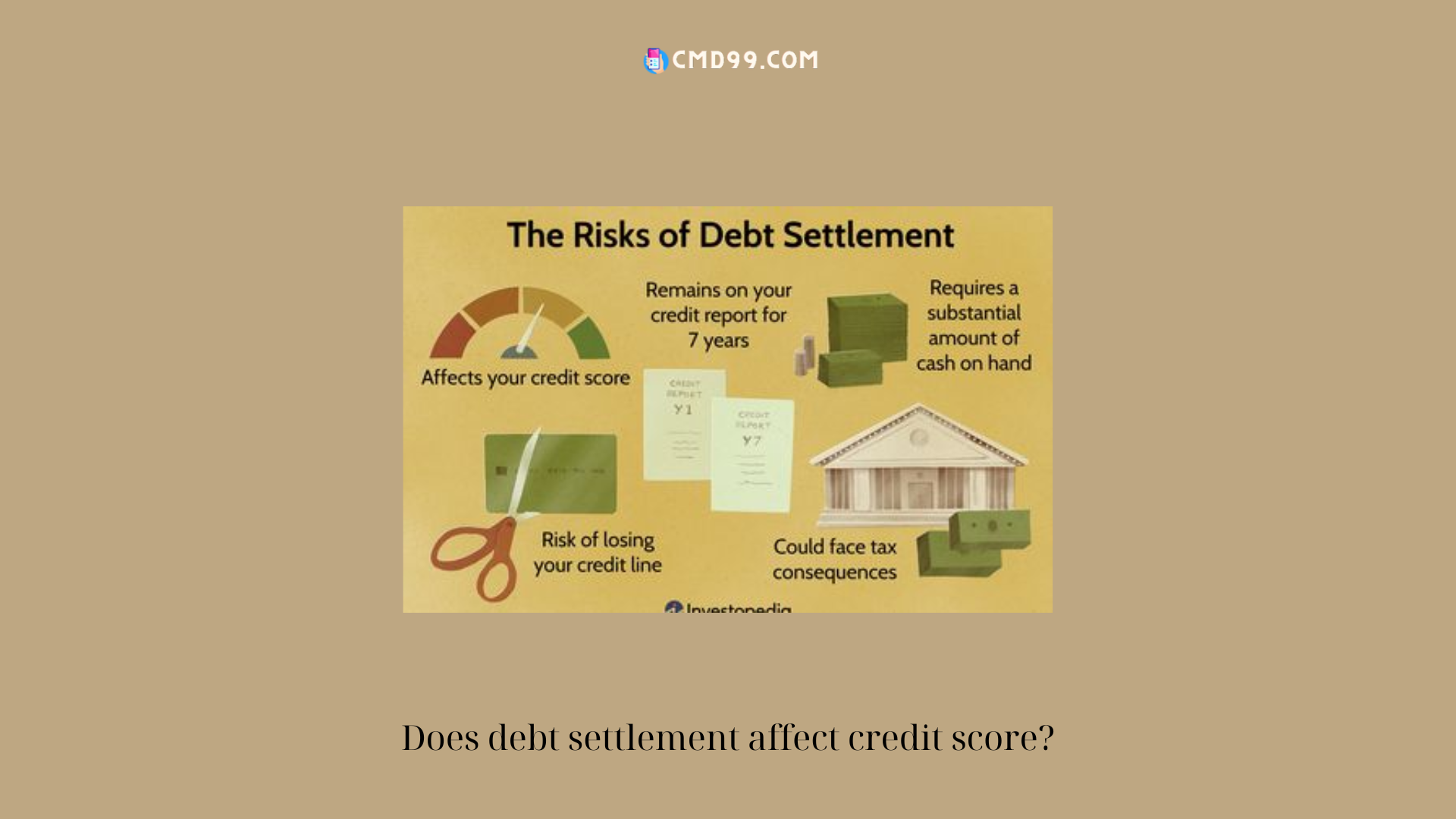

One of the most significant consequences of debt settlement is that it often leads to a derogatory mark on your credit report. Does debt settlement affect credit score? This negative mark, such as a “settled” or “paid for less than the full amount” notation, can remain on your credit report for up to seven years. Lenders and potential creditors reviewing your credit report in the future may interpret this mark as a sign of financial irresponsibility or an inability to manage debt effectively.

Furthermore, debt settlement can also impact your credit utilization ratio, which is the amount of credit you are using compared to your total available credit. The reduction in debt resulting from a settlement may initially seem positive for your credit utilization ratio. However, if the settled debt is reported as “charged-off” or “settled,” it can still have a detrimental effect. Does debt settlement affect credit score? Lenders may view a charged-off or settled account as an indication of higher risk and may be hesitant to extend new credit to you in the future or may offer credit at less favorable terms.

It is essential to note that the extent of the impact on your credit score depends on various factors, including the specific credit scoring model used and your credit history prior to the debt settlement. Does debt settlement affect credit score? Individuals with a higher credit score may experience a more significant drop compared to those with a lower credit score. Additionally, if you have a history of late payments or other negative marks on your credit report, the impact of debt settlement may be less severe in comparison.

While debt settlement can have adverse effects on your credit score, it is important to weigh these potential consequences against the benefits of resolving your debt. Does debt settlement affect credit score? If you are facing overwhelming financial difficulties and are unable to repay your debt in full, debt settlement may provide a viable solution to avoid bankruptcy or continued financial distress. It is crucial to carefully consider the long-term implications and seek professional advice before pursuing debt settlement.

If you decide to pursue debt settlement, there are steps you can take to mitigate the impact on your credit score. First, maintain open communication with your creditors throughout the negotiation process. Does debt settlement affect credit score? By demonstrating your commitment to resolving the debt, you may be able to negotiate more favorable terms, such as having the settlement reported as “paid in full” rather than “settled.” Additionally, once the settlement is reached, it is vital to focus on rebuilding your credit. Timely payments on any remaining debts, responsible credit utilization, and a consistent payment history can gradually help improve your credit score over time.

In conclusion, debt settlement can have a significant impact on your credit score and financial reputation. It is crucial to understand the potential consequences before embarking on the debt settlement journey. Does debt settlement affect credit score? While the negative effects on your credit score may be unavoidable, exploring alternative debt management options or seeking professional advice can help you make an informed decision. Remember, rebuilding your credit takes time and discipline, but with responsible financial habits, you can gradually improve your creditworthiness and regain your financial stability.