When it comes to managing your personal finances, understanding your credit score is crucial. Your credit score is a numerical representation of your creditworthiness, and it plays a significant role in determining your financial opportunities. Lenders, landlords, and even potential employers often rely on credit scores to assess your ability to handle financial obligations responsibly. In this article, Cmd99 will delve into the concept of what is a good credit score and a good credit score, its importance, and how it can impact your financial well-being.

What Is a Good Credit Score? Understanding the Importance of Creditworthiness

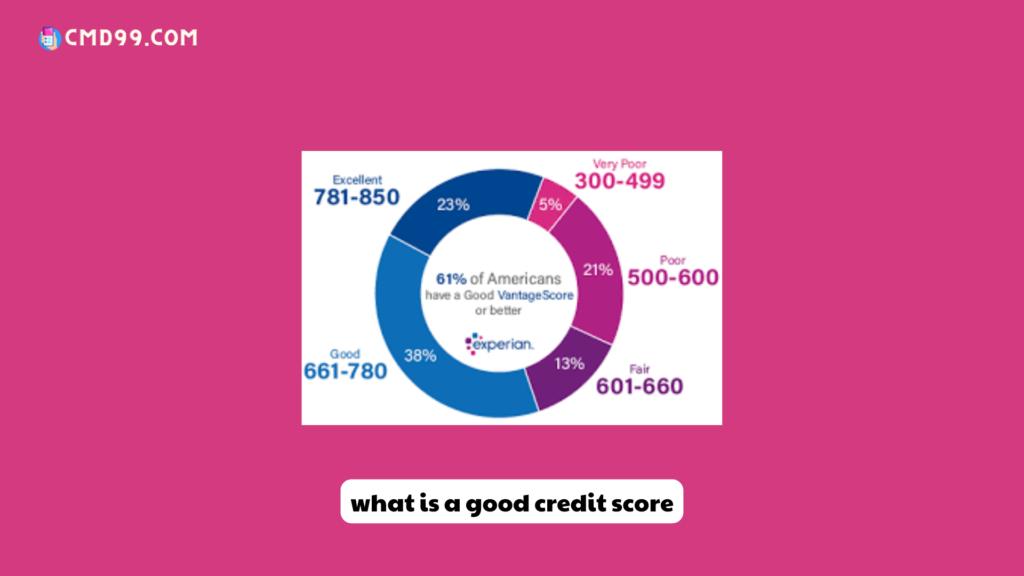

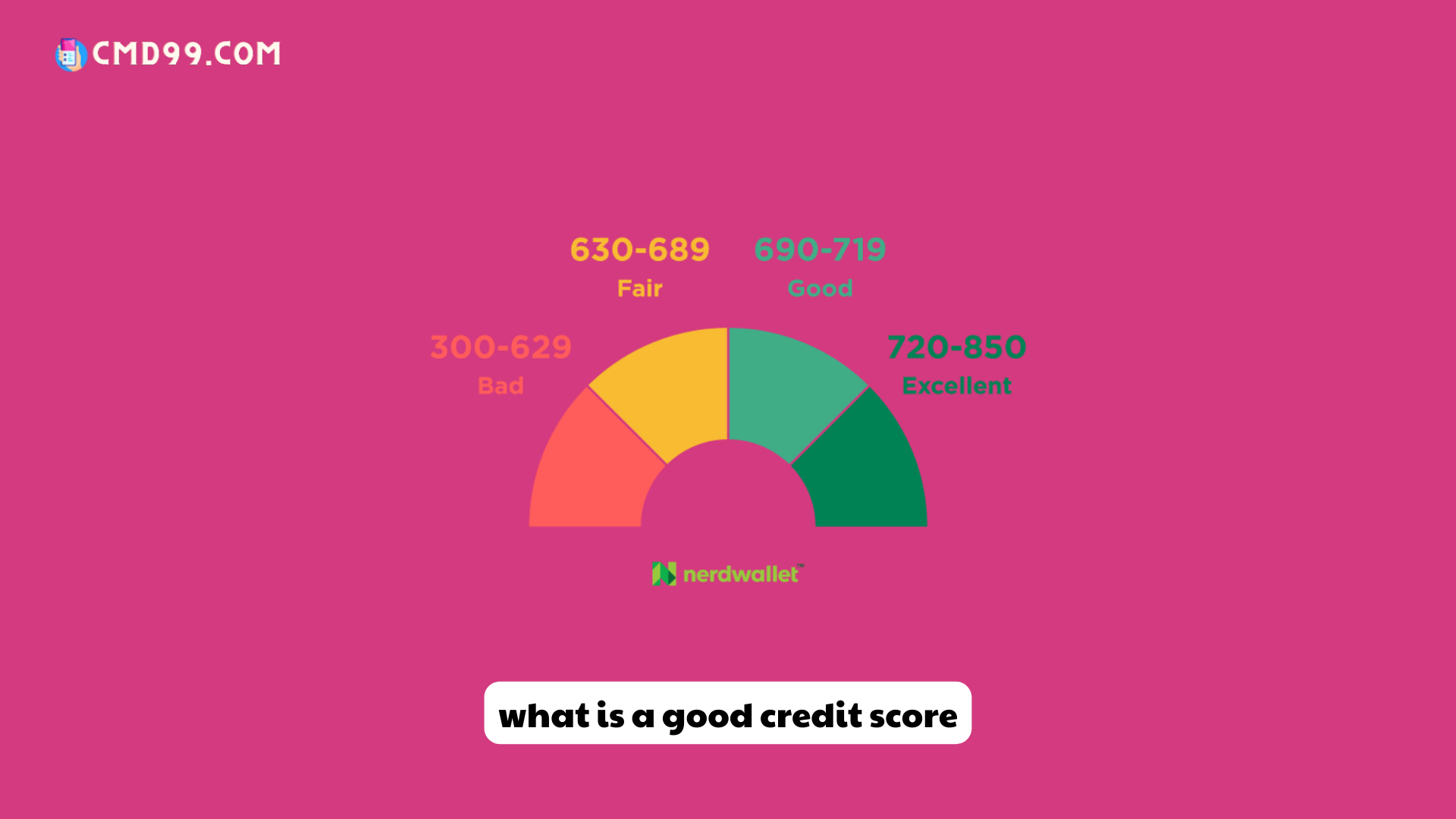

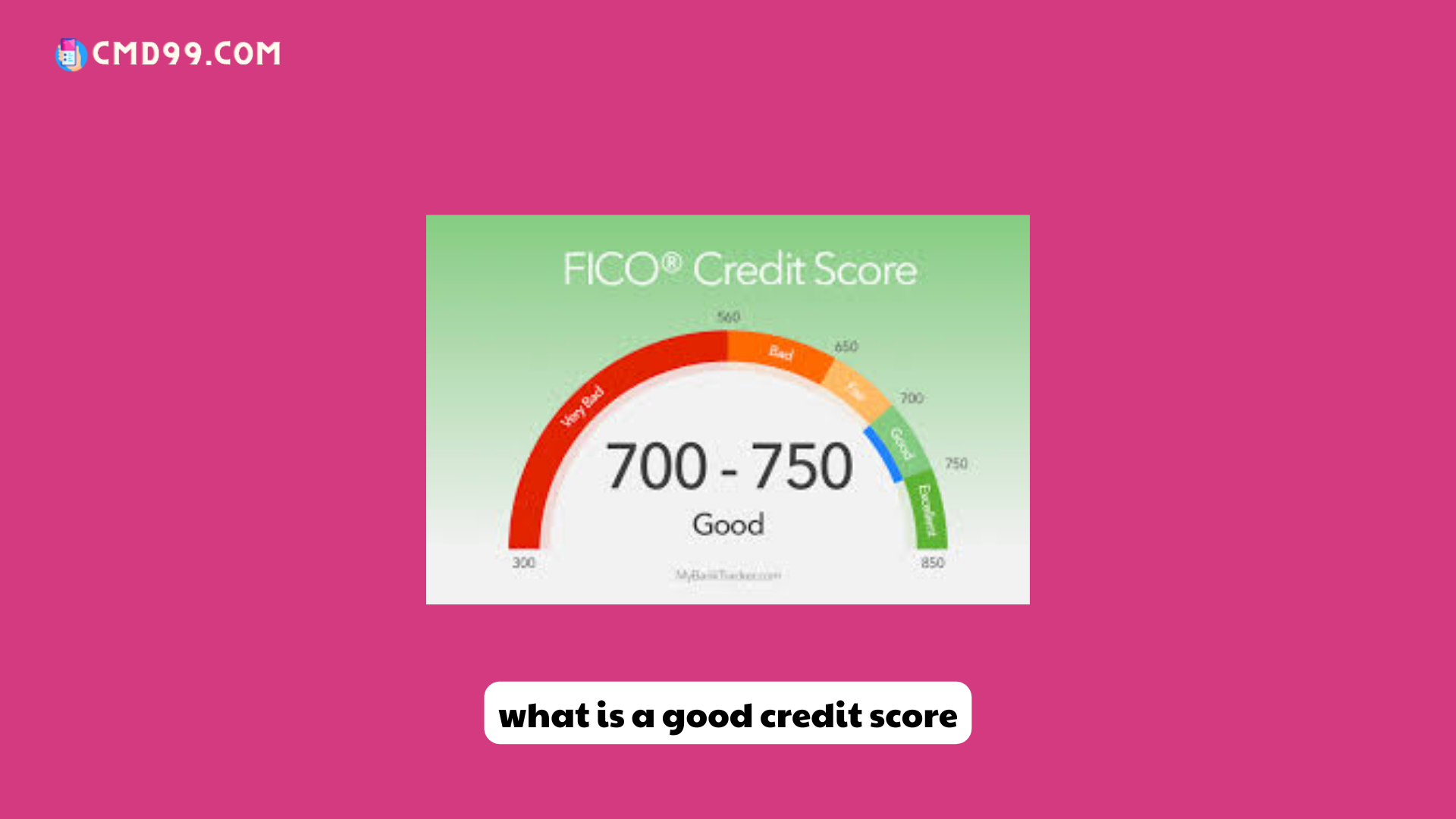

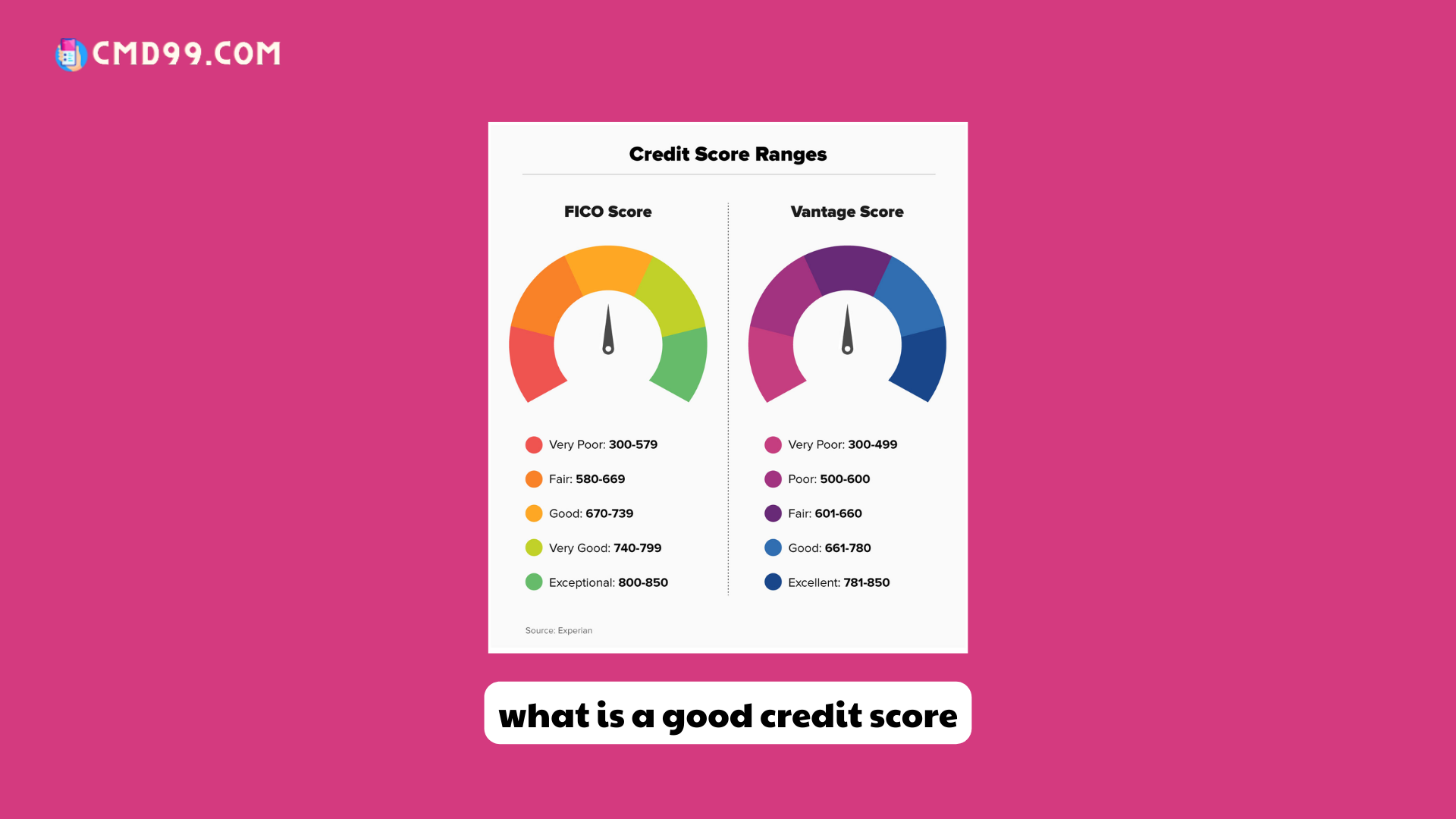

To begin, let’s define what is a good credit score. A credit score is a three-digit number that is calculated based on the information in your credit report. It is designed to reflect your creditworthiness and the likelihood of you repaying your debts. Credit scores are typically generated by credit reporting agencies such as Experian, Equifax, and TransUnion, using a variety of scoring models. The most commonly used scoring model is the FICO score, which ranges from 300 to 850. The higher your credit score, the more favorable it is considered.

So, what exactly constitutes what is a good credit score? While scoring models may vary slightly, a good credit score generally falls within the range of 670 to 739. However, it is important to note that different lenders and institutions may have their own criteria for what they consider a good credit score. Some might have higher standards, while others might have more lenient requirements. Nevertheless, aiming for a credit score within the range mentioned earlier is a good goal to strive for.

Having a what is a good credit score comes with a multitude of benefits. Firstly, it increases your chances of being approved for credit applications, such as loans, mortgages, and credit cards. Lenders view individuals with good credit scores as less risky borrowers, making them more likely to extend credit and offer favorable terms, such as lower interest rates and higher credit limits. This can result in significant savings over time and make borrowing more affordable.

Secondly, what is a good credit score can positively impact your insurance premiums. Insurance companies often consider credit scores when determining the rates for auto, home, and renters insurance. Studies have shown that individuals with higher credit scores tend to have fewer insurance claims, leading insurance providers to offer them lower premiums as a reward for their responsible financial behavior.

Moreover, what is a good credit score can enhance your housing prospects. Landlords and property management companies frequently review credit scores as part of the tenant screening process. A good credit score can give you an edge over other applicants and increase your chances of securing your desired rental property. It demonstrates your reliability and ability to meet financial obligations, assuring the landlord that you are a low-risk tenant.

Beyond financial matters, your credit score may even impact your career opportunities. Certain what is a good credit score employers, especially in industries where financial responsibility is crucial, may perform credit checks as part of the hiring process. While credit history is not the sole factor in the decision-making process, a good credit score can reflect positively on your character and level of responsibility, potentially setting you apart from other candidates.

Now that we understand the significance of a good credit score, let’s explore some strategies to achieve and maintain one. The first step of what is a good credit score is to establish a history of responsible credit management. This involves making timely payments on all your bills, including credit cards, loans, and utilities. Late or missed payments can have a negative impact on your credit score, so it’s essential to prioritize prompt payment.

Another crucial factor in maintaining a good credit score is managing your credit utilization ratio. This ratio refers to the amount of credit you are using compared to your total available credit. It is generally recommended to keep your credit utilization below 30%. For example, if you have a credit card with a $10,000 limit, it’s advisable to use no more than $3,000 of that credit at any given time. High credit utilization can signal financial stress and may negatively affect your credit score.

Regularly monitoring your credit report is what is a good credit score also essential. By checking your credit report periodically, you can ensure that the information being reported is accurate and up to date. Mistakes or inaccuracies on your credit report can harm your credit score, so it’s crucial to address any discrepancies promptly. You are entitled to one free credit report from each of the major credit reporting agencies annually, so take advantage of this opportunity to review your credit history.

In addition to these strategies, it’s important what is a good credit score to be patient and consistent in your credit management efforts. Building and maintaining a good credit score takes time and discipline. It requires responsible financial habits, such as avoiding excessive debt, minimizing new credit applications, and practicing restraint when it comes to opening new credit accounts.

In conclusion, understanding the concept of what is a good credit score and its importance is vital for anyone aiming to achieve financial stability. A good credit score opens doors to various opportunities, including favorable loan terms, lower insurance premiums, and increased housing options. By adopting responsible credit management habits and regularly monitoring your credit report, you can work towards improving and maintaining a good credit score. Remember, a good credit score is not onlyimportant for your financial well-being but also for potential employment opportunities. Take control of your creditworthiness and pave the way for a brighter financial future.