Establishing and maintaining a healthy credit score is essential for financial success and a credit score serves as a measure of an individual’s creditworthiness and can significantly impact their ability to secure loans, mortgages, and favorable interest rates for individuals with limited credit history or a less-than-ideal credit score, a credit builder loan can be a valuable tool in improving their creditworthiness. In this article, Cmd99 will explore the credit score impact of a credit builder loan and shed light on the relationship between these loans and credit scores.

Credit Score Impact of a Credit Builder Loan: Understanding the Relationship

I. What is a Credit Builder Loan?

A credit builder loan is a Credit score impact of a credit builder loan designed to help individuals build or improve their credit. Unlike traditional loans, the funds from a credit builder loan are typically not disbursed upfront. Instead, the loan amount is held in an account while the borrower makes regular payments over a predetermined period. This unique structure allows borrowers to demonstrate their ability to make regular and timely payments, thereby positively impacting their credit history.

II. How Credit Scores Are Calculated:

Credit scores are calculated using Credit score impact of a credit builder loan credit scoring models, such as FICO Score and VantageScore. These models evaluate factors such as payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. Payment history is typically the most significant factor, accounting for approximately 35% of the overall credit score. Therefore, making on-time payments on a credit builder loan can have a positive Credit score impact of a credit builder loan on a borrower’s credit score.

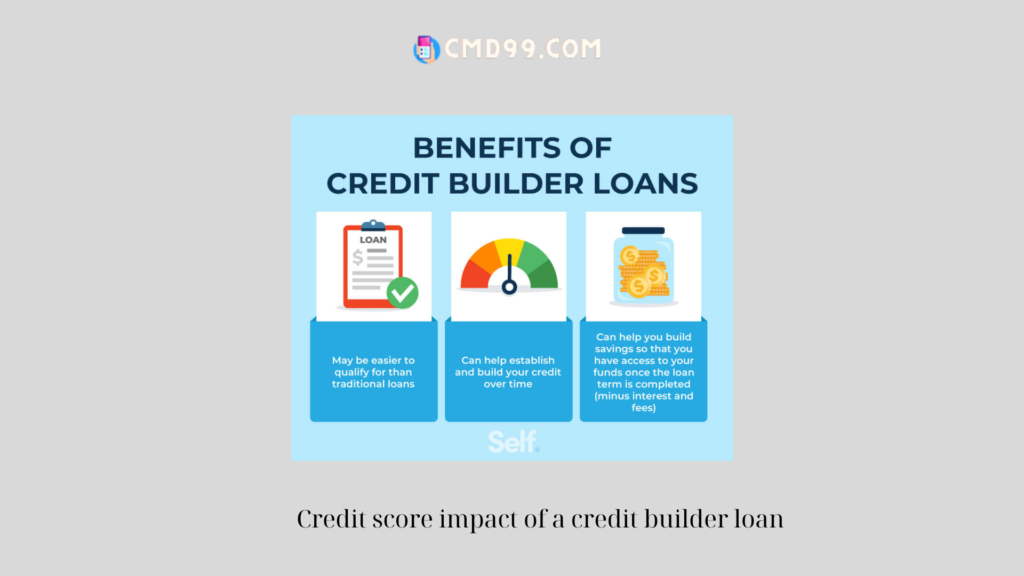

III. Positive Impact of Credit Builder Loans on Credit Scores:

- Establishing a Payment History: For individuals with limited or no credit history, a credit builder loan provides an opportunity to establish a positive payment history. Each on-time payment made towards the loan demonstrates responsible financial behavior, which can help build trust with lenders and improve creditworthiness.

- Diversifying Credit Mix: Credit builder loans can also contribute to a more diverse credit mix, which accounts for approximately 10% of the credit score calculation. Having a mix of different types of credit, such as credit cards, installment loans, and mortgages, can positively impact credit scores. By adding a credit builder loan to the mix, borrowers can demonstrate their ability to handle different types of credit responsibly.

- Reducing Credit Utilization: Credit utilization, or the amount of available credit that a borrower is using, is an important factor in credit scoring. A credit builder loan can help reduce credit utilization by increasing the total available credit. As borrowers make payments towards the loan, the available credit increases, leading to a lower credit utilization ratio and potentially improving credit scores.

IV. Considerations for Credit Builder Loans:

- Timely Payments: The most crucial factor in leveraging a credit builder loan for credit score improvement is making timely payments. Late or missed payments can have a detrimental effect on credit scores and defeat the purpose of the loan. Borrowers should ensure they have a repayment plan in place and budget accordingly to meet their loan obligations.

- Loan Terms and Interest Rates: It is essential to carefully review the terms and interest rates associated with credit builder loans. While these loans are designed to be accessible for individuals with limited credit history, borrowers should compare different loan options and choose the one that offers favorable terms and affordable interest rates.

- Monitoring Credit Progress: Borrowers Credit score impact of a credit builder loan should regularly monitor their credit reports and scores to track the impact of the credit builder loan. This allows them to identify any discrepancies or errors and take proactive steps to address them. Additionally, monitoring progress provides insights into how the loan is positively impacting their credit score over time.

V. Supplementing Credit Builder Loans with Good Financial Habits:

While Credit score impact of a credit builder loan can be instrumental in improving credit scores, it’s important to remember that they are not a standalone solution. To maximize the positive impact on credit scores, borrowers should practice good financial habits, such as:

- Paying bills on time: Consistently making on-time payments for all financial obligations, including credit cards, loans, and utility bills.

- Keeping credit utilization low: Maintaining a low credit utilization ratio by using only a small percentage of available credit.

- Avoiding excessive debt: Being mindful of debt levels and avoiding taking on more debt than necessary.

- Regularly reviewing credit reports: Checking credit reports for errors and addressing any inaccuracies promptly.

Conclusion:

Credit builder score impact of a credit builder loan can serve as a valuable tool for individuals looking to build or improve their credit scores. By establishing a positive payment history, diversifying credit mix, and reducing credit utilization, these loans can have a positive impact on credit scores over time. However, it’s important to remember that credit builder loans should be supplemented with good financial habits and responsible credit management. By combining the benefits of Credit score impact of a credit builder loan a credit builder loan with sound financial practices, individuals can take significant steps towards achieving a healthier credit profile and better financial opportunities.