Credit scores play a vital role in our financial lives, affecting our ability to secure loans, obtain favorable interest rates, and even rent an apartment. One common question that arises is whether paying off a loan can improve one’s credit score. In this article, Cmd99 will delve into the relationship between loan repayment and credit scores, examining the factors that influence credit scores and the potential impact of loan payoff on creditworthiness. By understanding Does paying off a loan improve credit score this connection, individuals can make informed decisions about managing their loans and improving their credit standing.

Does Paying Off a Loan Improve Credit Score? Understanding the Impact

- The Basics of Credit Scores:

a. Definition and Importance: Credit scores are numerical representations of an individual’s creditworthiness, indicating their ability to manage debt and repay loans. Lenders use credit scores to assess the risk associated with extending credit to individuals.

b. Credit Score Components: Credit scores Does paying off a loan improve credit score are calculated based on several factors, including payment history, credit utilization, length of credit history, credit mix, and new credit applications. Each factor contributes differently to the overall credit score.

- Understanding Loan Repayment and Credit Scores:

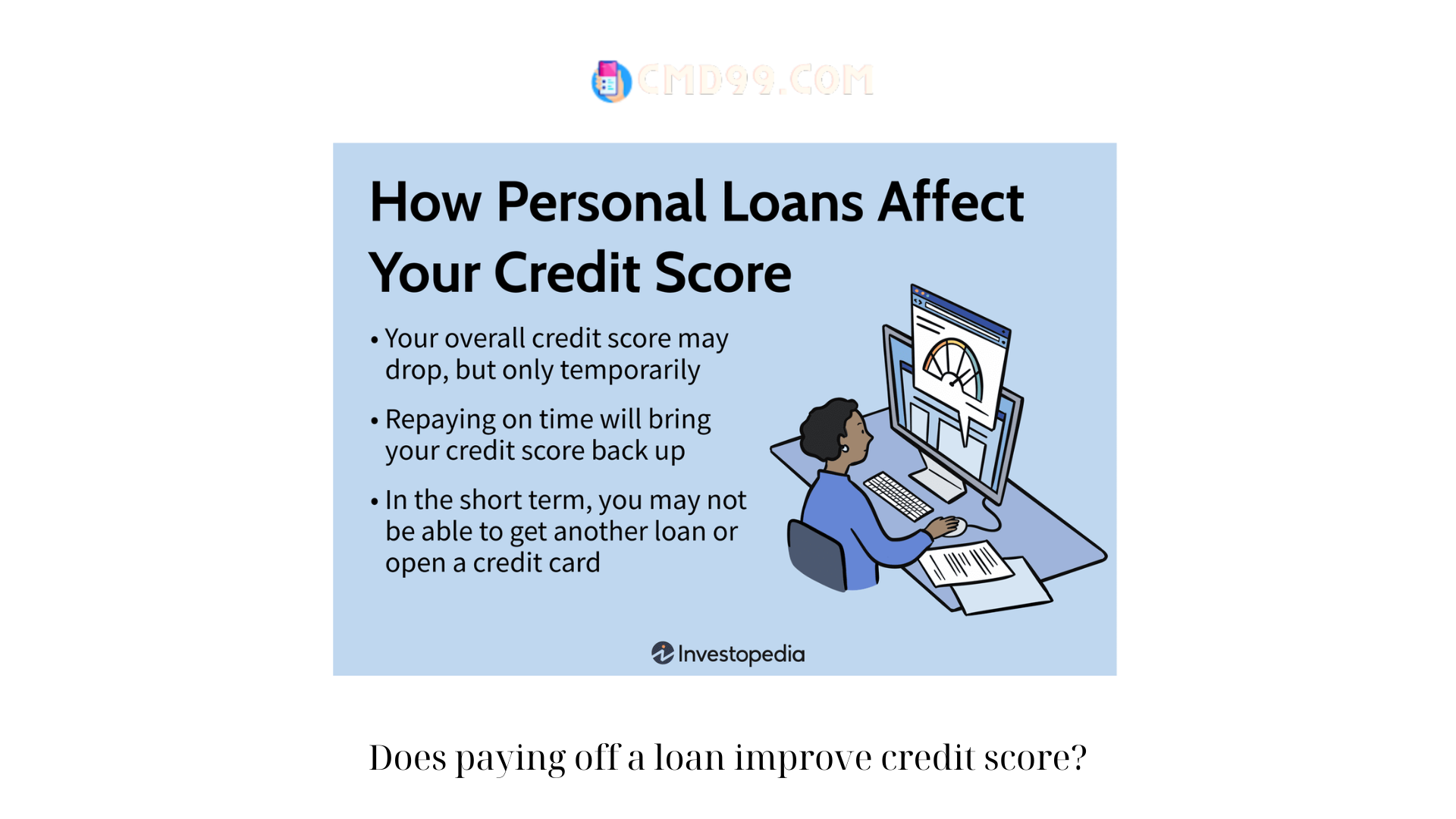

a. Timely Payments: Payment history is a significant component of credit scores. Making loan payments on time demonstrates responsible financial behavior and positively impacts credit scores.

b. Reduced Credit Utilization: Does paying off a loan improve credit score Paying off a loan reduces overall debt, which can lower credit utilization—a crucial factor in calculating credit scores. Lower credit utilization ratios are generally seen as positive indicators of creditworthiness.

c. Credit Mix Considerations: Does paying off a loan improve credit score Credit mix refers to the variety of credit accounts an individual holds. Paying off a loan can affect credit mix, as it reduces the number of installment loans. However, the impact on credit scores may vary depending on the individual’s overall credit profile.

- The Time Factor:

a. Credit History Length: Does paying off a loan improve credit score The length of credit history is an influential factor in credit scoring models. Paying off a long-standing loan may impact credit history length, potentially affecting credit scores. However, the exact impact will depend on other factors in the credit history.

b. Persistence of Positive Payment History: Once a loan is paid off, the positive payment history associated with it remains on the credit report for a certain period. This continued positive history can contribute to maintaining or improving credit scores over time.

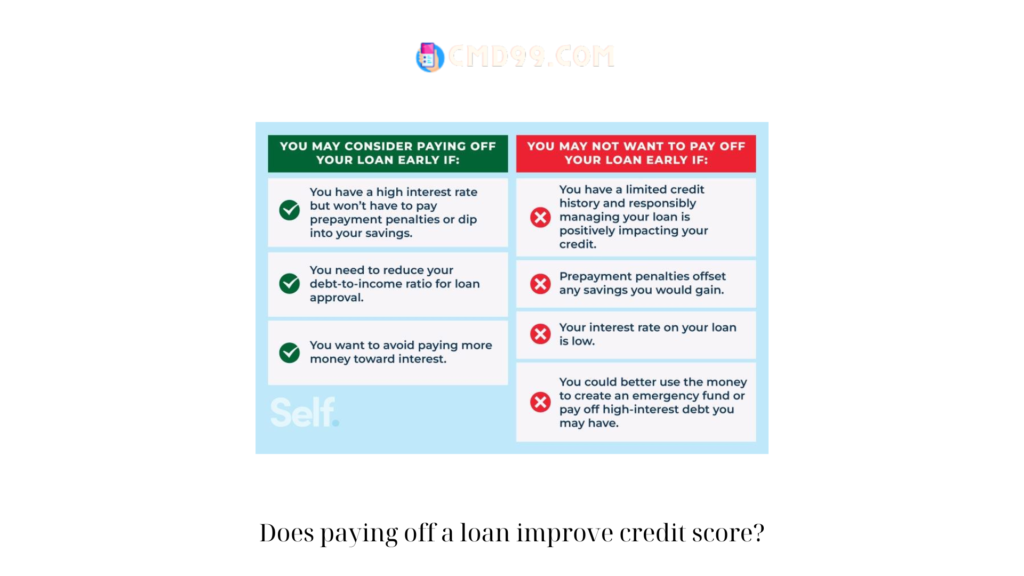

- Potential Short-Term Effects:

a. Temporary Score Fluctuations: Paying off a loan can result in temporary score fluctuations due to changes in credit utilization, credit mix, and other factors. It is important to understand that short-term fluctuations do not necessarily indicate a permanent negative impact on credit scores.

b. Credit Inquiries: In some cases, individuals may choose to pay off a loan before it matures, resulting in an early closure of the account. Does paying off a loan improve credit score. This may generate a credit inquiry, which can have a minor, temporary impact on credit scores.

- Long-Term Benefits and Creditworthiness:

a. Improved Debt-to-Income Ratio: Paying off a loan reduces overall debt, which can improve an individual’s debt-to-income ratio. A favorable debt-to-income ratio is viewed positively by lenders and can enhance creditworthiness.

b. Enhanced Financial Profile: Does paying off a loan improve credit score. A strong credit profile, including a history of successful loan repayment, demonstrates financial responsibility and can open doors to better loan terms, lower interest rates, and improved financial opportunities.

- The Role of Diversified Credit:

a. Positive Impact of Loan Variety: While paying off a loan reduces the number of installment loans, it is essential to maintain a diversified credit portfolio. A mix of installment loans, credit cards, and other credit accounts can positively influence credit scores.

b. Building a Strong Credit Foundation: Paying off a loan can free up resources to focus on building positive credit history in other areas. Responsible credit card usage and prompt payment of bills can help strengthen credit scores over time.

- Other Factors Influencing Credit Scores:

a. Comprehensive Credit Management: It is crucial to recognize that credit scores are influenced by multiple factors beyond loan repayment. Factors such as late payments, high credit card balances, and delinquencies can significantly impact creditworthiness.

b. Consistent Financial Responsibility: Does paying off a loan improve credit score. Paying off a loan is just one aspect of maintaining a healthy credit profile. Consistently demonstrating responsible financial behavior, including paying bills on time and managing credit responsibly, is essential for long-term credit health.

Conclusion

While does paying off a loan improve credit score paying off a loan can have various impacts on credit scores, its overall effect depends on individual circumstances and the broader credit profile. Timely loan payments, reduced credit utilization, and a diversified credit mix can positively influence credit scores. However, it is important to remember that credit scores are influenced by multiple factors, and loan repayment alone may not guarantee a significant improvement. By focusing on responsible credit management and maintaining a healthy credit portfolio, individuals can strive to improve their creditworthiness and secure better financial opportunities in the long run.