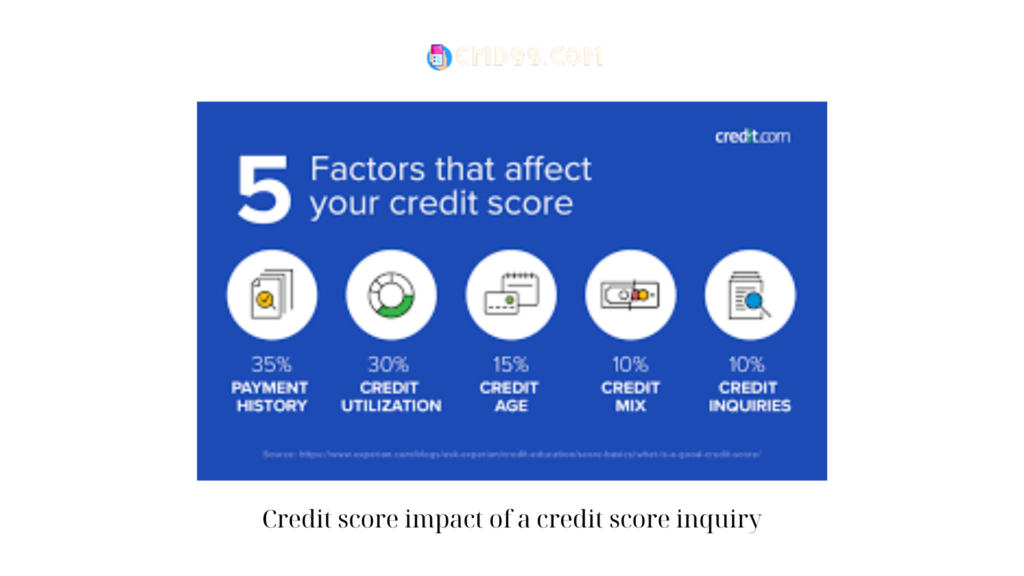

Your credit score plays a significant role in determining your financial health. It is a numerical representation of your creditworthiness, influencing your ability to secure loans, obtain favorable interest rates, and even rent an apartment. As you navigate the world of credit, it is crucial to understand how certain actions can impact your credit score. In this article, Cmd99 will delve into the credit score impact of a credit score inquiry, also known as a credit check or credit pull. We will explore the consequences of these inquiries and provide insights into managing them wisely to protect and improve your credit score.

Credit Score Impact of a Credit Score Inquiry: Understanding the Consequences Introduction

- The Basics of Credit Score Inquiries:

A Credit score impact of a credit score inquiry occurs when a lender or financial institution requests access to your credit report to evaluate your creditworthiness. There are two types of inquiries: hard inquiries and soft inquiries. Hard inquiries are initiated when you apply for credit, such as a loan, credit card, or mortgage. Soft inquiries, on the other hand, occur when you check your own credit report or when a creditor reviews your credit as part of a pre-approved offer. It is important to note that hard inquiries have a more significant impact on your credit score compared to soft inquiries. - Understanding the Impact of Hard Inquiries:

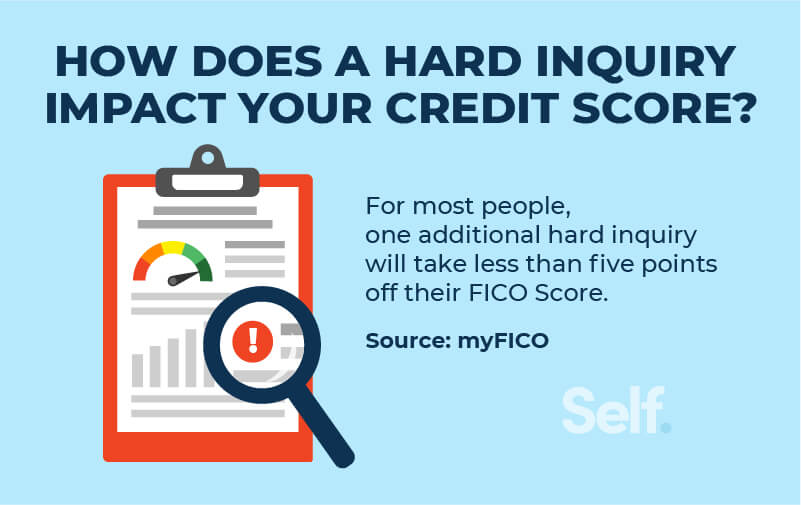

Hard inquiries have the potential to affect your Credit score impact of a credit score inquiry because they indicate that you are actively seeking credit. Each hard inquiry can cause a temporary dip in your credit score, typically ranging from a few points to five or more points. However, the impact of a hard inquiry is usually minor and short-lived, lasting for about two years on your credit report. - The Relationship Between Credit Score Inquiries and Creditworthiness:

Credit score inquiries are a reflection of your Credit score impact of a credit score inquiry behavior. Lenders interpret multiple inquiries within a short period as a sign of increased credit risk. It suggests that you may be taking on too much debt or experiencing financial difficulties. Consequently, multiple hard inquiries can have a more significant negative impact on your credit score, potentially signaling to lenders that you are a higher credit risk. - The Timing and Frequency of Inquiries:

Timing and frequency play a role in the Credit score impact of a credit score inquiry impact of inquiries. When multiple inquiries are made within a short period, such as a few weeks or months, credit scoring models may treat them as a single inquiry, minimizing the impact on your credit score. This allows you to shop around for the best loan or credit terms without unfairly penalizing your credit score. However, it is important to note that not all credit scoring models adopt this practice, so it is advisable to limit your credit applications to a reasonable number.

- Managing Credit Inquiries Wisely:

While it is essential to be mindful of the Credit score impact of a credit score inquiry impact of inquiries, it is equally important not to avoid necessary credit applications or limit your access to credit when needed. Instead, focus on managing inquiries wisely:a. Plan Ahead: Before applying for credit, research and compare different lenders and their credit requirements to identify the ones most likely to approve your application. This can help minimize the need for multiple applications and inquiries.

b. Apply Selectively: Be selective when applying for Credit score impact of a credit score inquiry and only pursue opportunities that align with your needs and financial goals. Avoid submitting multiple applications simultaneously unless necessary.

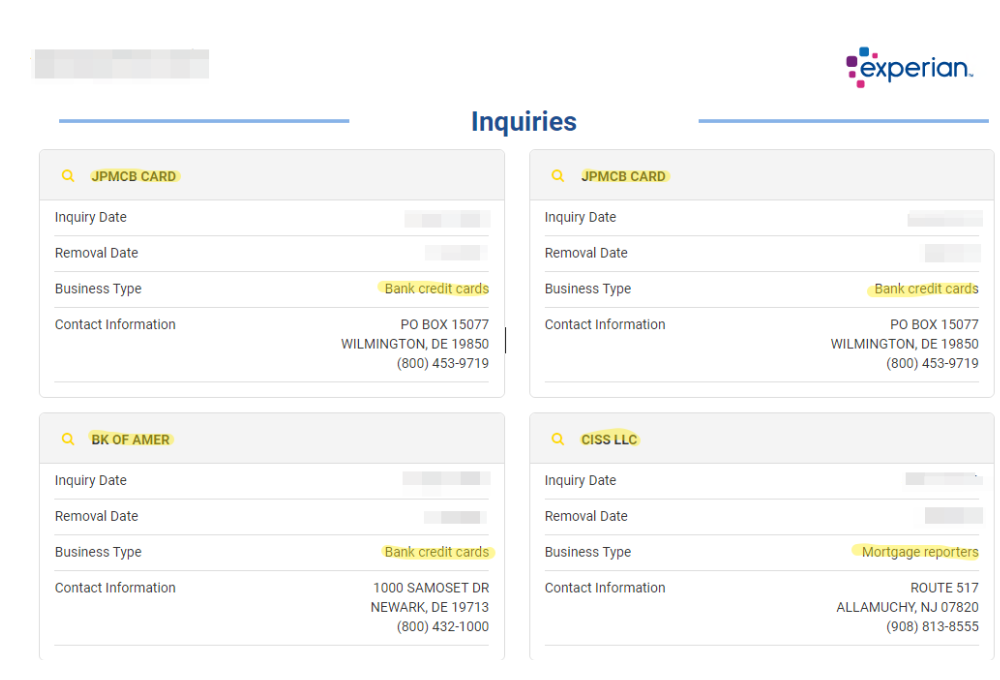

c. Monitor Your Credit Report: Regularly monitor your Credit score impact of a credit score inquiry report to ensure accuracy and identify any unauthorized inquiries. Reporting any inaccuracies or discrepancies promptly can help protect your credit score.

d. Be Mindful of Timing: If you anticipate needing credit for significant purchases, such as a mortgage or auto loan, plan your credit applications accordingly. This allows you to consolidate inquiries within a short period to minimize their impact.

e. Build Strong Credit: Focus on building a strong credit history and maintaining a good credit score in the long term. A solid credit history can help mitigate the impact of occasional inquiries.

- Soft Inquiries and Their Limited Impact:

Soft inquiries Credit score impact of a credit score inquiry, such as those made by employers, landlords, or when checking your own credit report, have no impact on your credit score. These inquiries are typically used for informational or verification purposes and do not reflect credit-seeking behavior. - Monitoring and Protecting Your Credit Score:

Regularly monitoring your Credit score impact of a credit score inquiry and credit report is crucial for understanding the impact of credit inquiries and maintaining a healthy credit profile. Consider the following tips:a. Use Credit Monitoring Services: Sign up for credit monitoring services that provide regular updates on changes to your credit report, including inquiries and other factors affecting your credit score.

b. Report Unauthorized Inquiries: If you notice any unauthorized inquiries on your Credit score impact of a credit score inquiry report, immediately contact the credit reporting agencies to have them investigated and removed.

c. Maintain Good Credit Habits: Focus on paying your bills on time, keeping credit card balances low, and managing your overall debt responsibly. These habits contribute to a positive credit score and can offset the impact of inquiries.

Conclusion:

Understanding the credit score impact of a Credit score impact of a credit score inquiry is essential for managing your credit wisely. While hard inquiries can have a temporary negative impact on your credit score, their significance is typically minor and short-lived. By being mindful of the timing and frequency of credit applications and practicing responsible credit habits, you can minimize the potential negative impact of inquiries. Remember to monitor your credit report regularly and report any unauthorized inquiries promptly. With proper knowledge and proactive measures, you can navigate the world of credit inquiries while safeguarding and improving your credit score.