In today’s business landscape, having access to credit is essential for growth and financial stability. A business credit card can provide convenient financing options and help establish a solid credit history for your company. However, like personal credit cards, business credit cards also have credit score requirements that must be met to qualify. In this comprehensive guide, Cmd99 will explore the topic of credit score requirements for a business credit card. We will delve into why credit scores matter, the typical credit score ranges for approval, factors that influence credit score requirements, and strategies to improve your creditworthiness and increase your chances of obtaining a business credit card.

Credit Score Requirements for a Business Credit Card: What You Need to Know

- The Importance of Credit Scores:

Credit score requirements for a business credit card play a vital role in determining your creditworthiness and financial health. They are a numerical representation of your credit history, reflecting your payment history, debt utilization, length of credit history, new credit accounts, and credit mix. Lenders, including credit card issuers, use credit scores as a key factor in assessing the risk associated with extending credit to a borrower. - Understanding Business Credit Cards:

Business Credit score requirements for a business credit card are specifically designed for business-related expenses and offer distinct advantages over personal credit cards. They provide a convenient way to manage business expenses, separate personal and business finances, track spending, and earn rewards tailored to business needs. Additionally, they can help establish a separate credit profile for your business, allowing you to build a strong credit history and potentially access higher credit limits in the future. - Typical Credit score requirements for a business credit card:

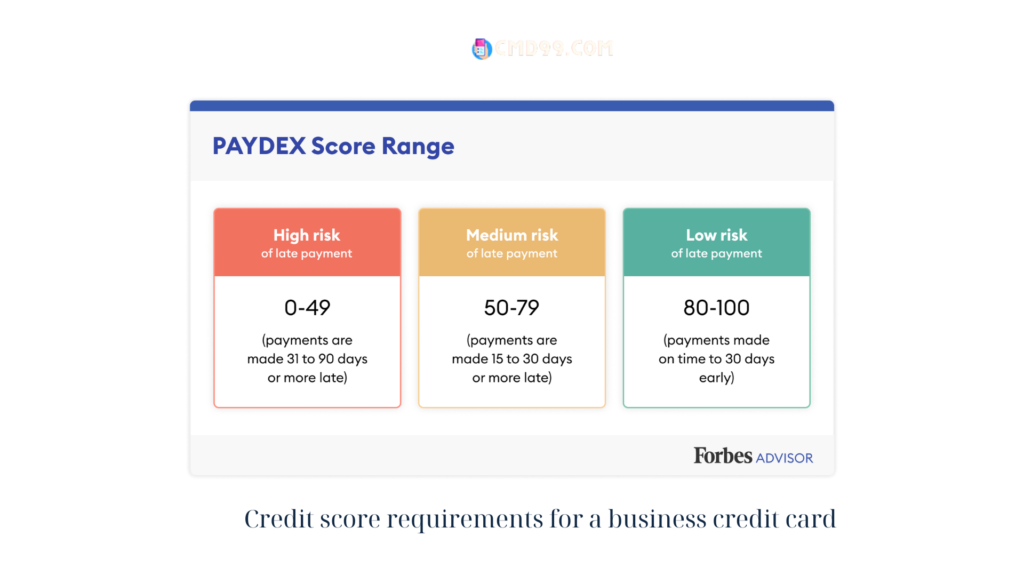

Credit score requirements for business credit cards vary among issuers and the specific card you are applying for. While there is no universally defined credit score threshold for approval, most business credit cards require a good to excellent personal credit score. Generally, credit scores in the range of 670 to 850 are considered good to excellent, increasing your chances of qualifying for a business credit card. - Factors Influencing Credit Score Requirements:

Several factors influence the credit score requirements for a business credit card. These include the issuer’s risk appetite, the specific card’s features and benefits, the target market of the card, and the economic climate. Additionally, the issuer may consider factors such as your business’s revenue, years in operation, and other financial indicators when evaluating your creditworthiness. - Strategies to Improve Creditworthiness:

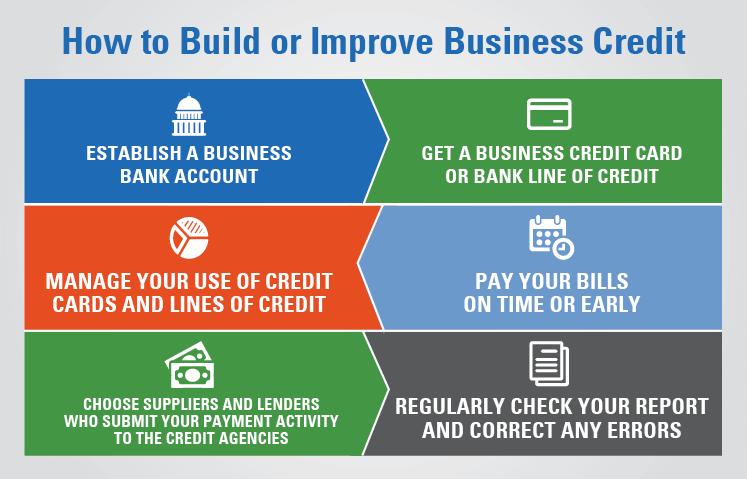

If your personal credit score does not currently meet the credit score requirements for a business credit card, there are steps you can take to improve your creditworthiness over time. These strategies include making timely payments on existing debts, reducing credit card balances, minimizing new credit applications, and monitoring your credit report for inaccuracies. Over time, these actions can positively impact your credit score and increase your chances of qualifying for a business credit card. - Building Business Credit:

Building a separate credit profile for your business is crucial for accessing business credit cards with favorable terms. To establish business credit, you can open accounts with vendors and suppliers who report payment history to business credit bureaus, maintain a positive payment history, and ensure that your business is properly registered and structured. Building a strong business credit history will enhance your creditworthiness and increase your chances of meeting credit score requirements for business credit card approval.

- Alternative Options for Limited Credit History or Lower Credit Scores:

If you have limited credit history or a lower personal Credit score requirements for a business credit card, there are alternative options available to access credit for your business. These include secured business credit cards, which require a cash deposit as collateral, and business charge cards that require payment in full each month. These options can help you establish or rebuild your credit history and demonstrate creditworthiness over time. - Choosing the Right Business Credit Card:

Once you meet the credit score requirements for a business credit card, it is important to choose the right card that aligns with your business needs and goals. Consider factors such as rewards programs, interest rates, annual fees, introductory offers, and additional features and benefits. Compare different card options and select the one that best suits your business’s spending habits and financial objectives. - Applying for a Business Credit Card:

When you are ready to apply for a business credit card, gather the necessary documentation Credit score requirements for a business credit card, including your business’s EIN (Employer Identification Number), financial statements, and personal identification information. Fill out the application accurately and completely, providing supporting documents as required. Remember to review the terms and conditions of the card carefully before submitting your application.

- Conclusion:

Credit score requirements for a business credit card play a crucial role in determining your eligibility for this valuable financial tool. By understanding the importance of credit scores, implementing strategies to improve your creditworthiness, and exploring alternative options for limited credit history or lower credit scores, you can increase your chances of meeting the credit score requirements and accessing the benefits of a business credit card. Remember to choose the right card for your business needs, maintain responsible credit practices, and monitor your credit regularly to ensure continued financial health and access to credit resources.